Is wind locking us into fossil fuels?

15 June 2021

As we pointed out in an earlier news item, in the first quarter of 2021 the supply of energy to the GB grid from wind plummeted by 18% compared to 2020.

But apart from worrying and unpredictable overall slumps, the incidence of extended wind lulls presents us with a related and additional problem. How and when can we end our reliance on fossil fuels if we keep increasing our dependence on wind?

May 2021

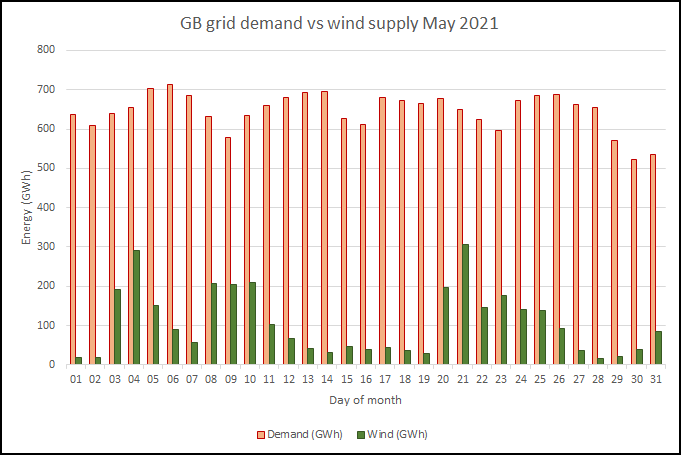

We have used the Elexon official GB figures for electricity generation for the grid to show energy demand for each day in May 2021. This is shown by the red columns in the following graphic. It includes national demand and station load but not pumped storage pumping or exports. The green columns show the amount of energy contributed by wind to meeting this demand on each day.

Other fuel sources met the balance of this demand, including nuclear, biomass, imports, gas, coal, etc.

In May 2021 "the lights stayed on" for GB grid users.

May 2021 in 2030

What would happen if the same weather and wind pattern repeated in 2030? Could the GB grid cope?

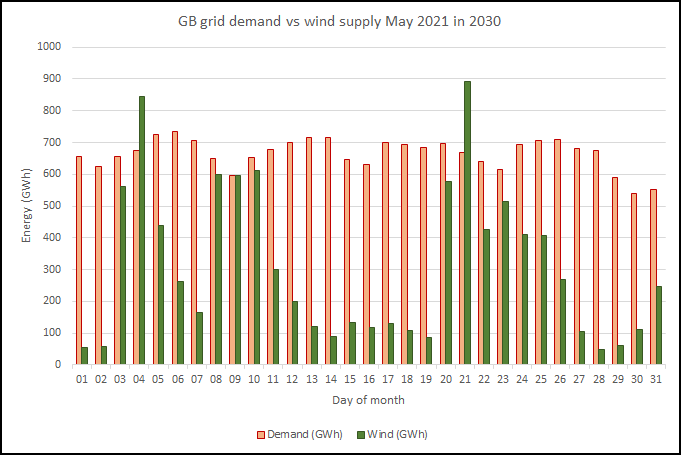

Let's start with the projected changes to demand and wind in the Leading the Way scenario in the National Grid's FES 2020 documents:

- Demand is to increase by 3% (we'll exclude demand for electrolysis of hydrogen as this is to be met mostly by excess wind power).

- Wind capacity will have increased to almost 3 times its current value at about 58,650GW.

The following chart shows projected demand against projected wind supply.

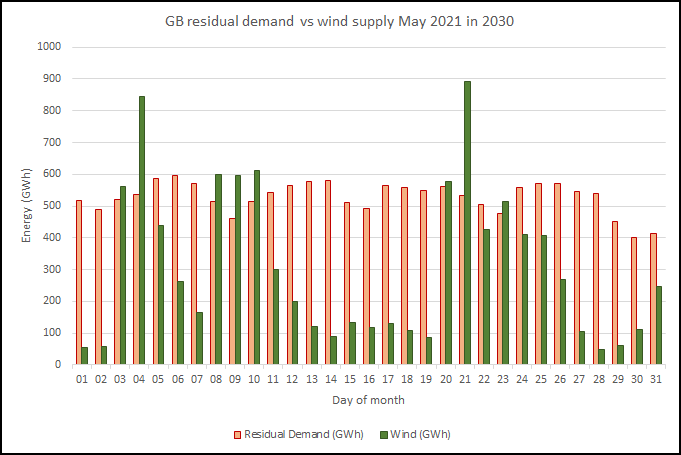

Let's look at some of the other relevant projected changes. For all of these we will reduce Demand to Residual Demand to reflect their use:

- Nuclear capacity will be about 50% of the current value (and that assumes that Hinkley Point C is operational by then). We'll use half of the energy generated in 2020 and spread it evenly throughout the year.

- There's no more coal or other significant fossil fuels other than small amounts of OCGT Gas, etc.

- Hydro capacity will be about the same.

- Biomass overall will be at about the same level of generation, although the current Biomass will have been supplemented by CCS Biomass.

- Generation from Waste will have stayed at about current levels, with less than 2,000 GWh in the year.

- Annual generation from Marine sources will have increased to just over 1,800 GWh.

This chart shows the outstanding deficit for each day:

As you can see, there are periods of time when demand can be met, but others where it can't. The total deficit is just under 8,000 GWh. What are our options when there is a deficit?

Storage

Storage (excluding V2G) with power just under 10 GW and storage capacity of about 108 GWh will be available, although this will require very considerable increases on what we have now. This could provide almost 10GW for about 11 hours, which would be hopelessly inadequate to make any real impact on these deficits. Note that in the longest wind lull from 11th to the 19th the total deficit is over 3,650 GWh.

There is also the problem of limited opportunity to recharge the storage when it has been exhausted with such a sequence of wind lulls.

The National Grid projection for V2G storage capacity is about 21.7 GWh with a peak power of 1.5 GW, so this could make even less of a contribution.

So, storage could only make an extremely small contribution to solving this problem.

Interconnector imports

Projected capacity is 21.45 GW, so if we could get all of that for a day we could import just over 500 GWh, which would sometimes be enough.

Of course, we might not be able to get anything from interconnectors as we cannot guarantee availability. Dependence on interconnector imports would present a risk to independence and continuity of supply.

The total projected imports for 2030 are 36,630 GWh, or roughly 4.5 times the deficit in this month.

So, it is possible that imports could fill some of these gaps, although we could not be confident in advance that any particular amount of energy could be supplied at any specific time.

However, it is also projected that we will export more than twice this figure, 74,300 GWh in fact. The National Grid's stated aim is to export surplus energy. We will need to export according to any commitments we make to our partners. Currently we export much less than we import.

CCGT Gas

CCGT Gas capacity will have decreased to 15.7GW, limiting the power available to a lower figure than today. Projected annual generation is just over 16,000 GWh. This generation figure is important as exceeding it will endanger our emissions target.

Also, with the lower power of 15.7GW there may well be situations where even CCGT Gas cannot keep the lights on.

However, we know that we can control CCGT Gas, and - subject to the reduced limit on power - we can use it with a high level of confidence in its availability.

Excess capacity

One other point to note here is that where there is excess generation - in this case 1,085 GWh - the National Grid projections allow for various uses:

- Export it. This would help to meet our export commitments (see above) and earn income. However, whether we could export as much energy as the National Grid anticipates is an important question. Some analyses treat the anticipated exports as additional demand. If we do that each month would have an additional demand of over 6,000 GWh.

- Charge storage.

- Create green hydrogen by electrolysis.

At present, of course, excess capacity/generation can be dealt with by constraint payments, but in the future they may become unnecessary as we may always be able to use any excess.

Conclusion

GB demand is reasonably predictable, and is mostly met by reliable and/or controllable supply sources.

By making our main source of supply wind - which is a variable, unpredictable and uncontrollable resource - we need to have backup sources that can do the job when wind can't.

In a month like May 2021 the projected storage capacity would be hopelessly inadequate.

If we could get enough interconnector imports it is possible that some of the shortages could be avoided, but how likely is it that demand could always be met? At present our major source of imports is France, where most electricity is generated from nuclear sources. Other sources for other partners include gas, coal and even peat. As we increase the options for import, a lot will depend on how reliable the sources are. For example, if partners use wind extensively they are less likely to have spare energy when we need it than a partner where the source is relatively steady, as it is with nuclear.

So, we would have to burn enough gas to keep the lights on, almost certainly exceeding our emissions targets or having insufficient power. The likelihood is that the only option available to us would be to burn as much gas as we need to, and even then it is likely that sometimes there would not be enough power to keep the lights on.

This is why it seems very likely that CCGT Gas is going to continue to be our fallback source.

How rare or exceptional is a month like May 2021? It's not at all rare. This review of wind lulls in 2020 shows the scale of the problem. Of course we can't predict when these months are going to occur, as they are unpredictable.

By all means perform the same operation using the National Grid's Consumer Transformation or System Transformation scenarios yourself. We believe that the conclusions are similar whichever of the scenarios that achieve net zero you apply.

In a subsequent article we will project forward to 2050.